Contents

The fear and greed index is measured frequently, mostly daily. It shows if the market is bullish or bearish based on the measurement of investors’ sentiments towards the market. It could be a buying opportunity when the index indicates that investors are fearful. On the other hand, the market is due for a correction when the index deducts greed in the market. Stoch RSI being more sensitive moves more quickly from an overbought to an oversold level than RSI. Both RSI and Stoch RSI, when used in conjunction with other indicators, can be highly useful for predicting price movements in the crypto market.

How do you spot a crypto pump?

There are a few signs that can help you recognize a pump and dump scheme, such as: A new and unknown cryptocurrency starts receiving a lot of attention on social media. Celebrities or influencers getting behind a new cryptocurrency, often using similar scripts. Charts show a sudden price hike in a new crypto project.

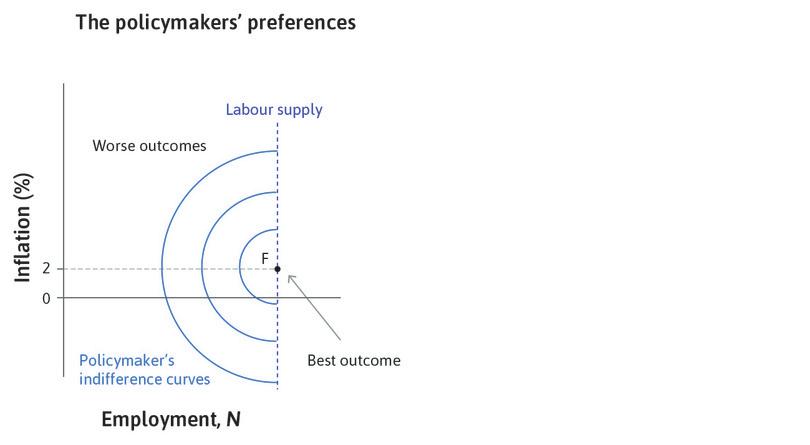

You can also follow other indicators and combine them the same way as explained above for intra-day trading using momentum indicators. Brave investors can use the index to invest against market trends. This strategy usually works in a volatile market by taking advantage of trends when other investors The Hongkong and Shanghai Hotels are scared to invest. Crypto investors need not invest without any direction or spend hours on research with the help of the fear and greed index. The price of Bitcoin is high when there is greed in the market. The same applies to low Bitcoin prices when the market is experiencing fear.

To get a more in-depth insight into the asset’s price, crypto traders can use these indicators. Traders mainly use this indicator to determine the quality of price movement. Ideally, the indicator uses the past 14 days’ prices to get a defined score. You can say that the asset is overbought if the score is above 80, and it is oversold if the score is below 20. You can indeed find many technical indicators prevailing in the market, especially on the big exchanges.

These patterns give an idea of where these prices could go in the future depending on their past behavior. They form the basis of any technical analysis and, depending on the context, tell the trader what could be done next. A crypto chart is a graphical representation of the market movement. It tells us the direction of the movement and volumes for different time frames.

Most Read

Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account. The head and shoulders is a chart pattern that appears when a stock rises to a peak to form the first “shoulder” and then falls.

How do I monitor crypto in real time?

- Go to 'Settings' > 'General' > and turn on 'Real-time prices'

- Go to 'Favorites' and tap on the '+' in the top right corner.

- Search for the cryptocurrency you want to add then tap on it e.g. DOGE.

- Search for the market you want to track e.g. USDT on Binance. (

- Tap on that market to add it.

Similarly, resistance is formed at a point of maximum selling interest. If a stock is going up, it is likely to come down from its resistance levels and vice-versa. Understanding the patterns would help traders make an informed decision. However, trading in crypto requires an efficient trading platform.

There is no hard and fast rule for the markets to stick to these patterns. Therefore, efficient trading requires a lot of practice and experimenting. With indicators out of the way, it is time to dive deeper into the patterns.

Crypto Trading Indicators – List of Top Cryptocurrency Technical Indicators

And trust me, this one doesn’t require you to go through a steep learning curve. Coin Sets by Mudrex helps you invest in theme-based baskets of crypto. These baskets are managed by experts so that you don’t have to. Some of the wealthiest players in crypto have made their fortune by trading. I don’t see a reason that stops you from repeating what they did.

Quite simply, inflow refers to the amount of a particular cryptocurrency that has entered the exchange within a given period. And outflow refers to the amount of a cryptocurrency that has left the crypto exchange over a given period. What the accumulation/distribution line (A/D line) seeks to determine if money is flowing into or out of a security.

How to Read Crypto Charts?

After this calculation, a 9-day EMA of the MACD, also known as “signal line” is plotted on a graph along with the MACD line. It acts as an indication to all traders whether to buy or sell. The Simple Moving Average Indicator or SMA indicator is the most basic type of indicator traders rely on to device a trading strategy. It shows traders the average price of their trades, over a specific time. Essentially, it helps traders understand whether the price of their securities, commodities, foreign exchange, etc., is moving up or down, thereby helping them to identify a trend. SMA is regarded as an arithmetic moving average in which traders typically add the recent closing prices and then divide the price by the number of periods to calculate the average.

Since crypto markets are heavily driven by volumes, it is a good way of validating a particular trend. OBV will go up and down depending on the volume of the trade. Well, usually, traders would buy near the support levels as they indicate increased buying interest. Similarly, they would sell near resistance as the prices are likely to go down from there. SMA, or simple moving average, simply adds up the prices on each day and divides it by the number of periods. A technical indicator is displayed graphically and evaluates volume and price simultaneously.

Start Trading Now

This could result in a sizable move during after hours trading, and the stock picks up at this point when the normal trading day gets under way. Gaps are important because they create new support or resistance lines for the security. Traders set up sell orders using these support and resistance points as their stop loss or limit.

We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. In simpler words, the lower the RSI, the more undervalued is the asset. As you can see from the example, Bitcoin exhibited an upward trend every time the RSI reached a major low and exhibited a downward trend when RSI peaked.

On the other end of the spectrum, 100 suggests that the crypto market is getting greedy and that investors are buying. The numbers are calculated by monitoring the buy and sell volumes of the market. The purpose of a fear and greed index is to evaluate the two primary emotions influencing investors’ decision-making.

- It could be a buying opportunity when the index indicates that investors are fearful.

- A support level is formed at a price where there is heightened buying interest.

- This indicates momentum, which measures if a crypto is overbought or oversold.

- It is measured between 0 and 100 and is a more sensitive indicator than RSI.

- You can say the asset is overbought if the asset is around 70, and it is oversold if the asset is around 30.

Unlike the real-world shooting stars where you’d make a wish, this one is a bearish pattern. It is named so because it looks like a constant fall into oblivion. It is represented by a small body which means that price has fallen slightly during the day.

Forex indicators

WazirX is one such platform where you can not only take positions but also effortlessly spot these patterns and indicators every day. It helps in signaling the direction of the price movement and tells about its strength. You can say it is an upward momentum when the score is above 0.

Traders can use multiple indicators to forecast price movements easily. You can calculate the trend here by subtracting the 26-day exponential moving average from the 12 days EMA of the cryptocurrency. One can say the signal is positive when the 12 days EMA is above 26. On the other hand, a few traders choose to rely on historical prices to understand the price movement instead of using fundamental indicators.

Of course, you may not need all of them, but you can choose the indicator that best suits your trading strategy, say the best indicator for intraday trading. The question that any traders often ask themselves is whether technical indicators and fundamental analysis are reliable in the market. Technical analysis is done on the basis of the reading of market sentiments, using patterns on graphs, as well as certain signals of trading.

The indicator is amazing to analyze the support and resistance levels besides the trend direction. Throughout the crypto trading community, RSI is one of the most popular trading indicators. Basically, the traders choose to use the technical analysis tool to measure both strength of dynamics and the price of the asset. Basically, in technical analysis, they are mathematical calculations or signals which help in analyzing what might happen next in the price of a stock, commodity, etc. Showing breadth of market as a percentage change to gauge buyers/sellers strength. You can check this on the last day of the week and compare each daily bar to see if buyers are increasing/decreasing or sellers increasing/decreasing bars.

Traders – People who buy Bitcoin intending to sell it quickly at a profit. If you want to grow your money faster than traditional methods by investing in Bitcoin, honing your technical analysis skills is critical. A good technical analyst of a stock or a commodity can make a lot of money for himself, but a good technical analyst of a cryptocurrency can shoot to fame and fortune in a very short time. Over time, there are a plethora of indicators available in the market; traders can choose any as per their convenience. Hello everyone, I am a heavy Python programmer bringing machine learning to TradingView. This 15 minute Bitcoin Long strategy was created using a machine learning library and 1 year of historical data in Python.

This generally creates scarcity in the market and could cause prices to spike. If you haven’t yet developed your cryptocurrency trading strategy and are looking for indicators that will help you to do so, we got something for you. There are dozens of indicators https://1investing.in/ that can be displayed on the charts, but here is an outline of the most important technical indicators to know. While both indicators are momentum indicators, RSI is derived from a set of prices, while Stoch RSI is more a derivative of a set of RSI values.

The moving average is calculated by simply taking the average of the data points in a given period of time. Therefore, any negative sentiment in crypto markets now has more impact on investor sentiment in equity markets and vice-versa. In the technical analysis of stocks, the head and shoulders pattern gets formed when any stock’s price goes up to a peak and subsequently falls back to the base point of the previous move. Then, you will find that the stock price rises over the former peak and forms a “nose”. Declines to the original price will happen next, and then the stock price will increase to the level of the first peak. You tend to see this pattern when a bullish to bearish trend reversal is going to happen.